| Short Term Bulls vs. Bears Scoring System | ||||

| Short-term buy signal: Bulls>Bears and Bulls>=25; Sell signal: Bears>Bulls and Bears>=25 | Signal History | |||

| Comments: We had a great vacation in Washington DC this week. Sorry I missed a few days of market summary. Again I feel the mkt wants to go up, but it has to fight against bad econ numbers. SPY 110 is my number to watch. As long as SPY is above 110, any pullback is a buying opportunity. Have a great weekend. Thanks for staying with this blog. | ||||

| Summary of S&P 500 Stocks Daily Price Change Behavior Model 8/6/2010 | ||||

| Type of Daily Move | # of Stocks | Percent of all stocks | Avg Move | Symbols of the Moves |

| UP over 2 STD | 3 | 0.6 | 2.62 | Click here to show stocks |

| UP between 1 to 2 STD | 12 | 2.4 | 1.22 | Click here to show stocks |

| UP between 0 to 1 STD | 157 | 31.46 | 0.3 | |

| DOWN between 0 to 1 STD | 297 | 59.52 | -0.42 | |

| DOWN between 1 to 2 STD | 24 | 4.81 | -1.36 | Click here to show stocks |

| DOWN over 2 STD | 6 | 1.2 | -2.8 | Click here to show stocks |

| Total # of UP Moves | 172 | 34.47 | 0.41 | |

| Total # of DOWN Moves | 327 | 65.53 | -0.53 | |

| Total | 499 | 100 | -0.21 | |

| Note: | ||||

| How to read this table | ||||

| Intermediate Term Market Mode | ||||

| Comments: | ||||

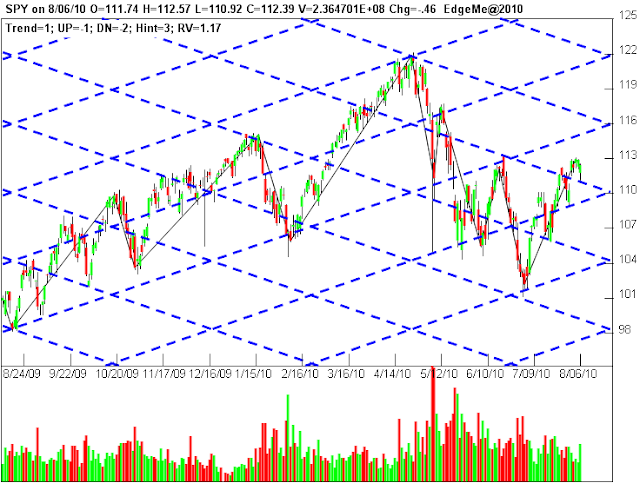

| Long Term ZigZag View of SPY | ||||

| Comments: SPY chart still looks great. | ||||

Guesstimates on January 30, 2026

4 hours ago