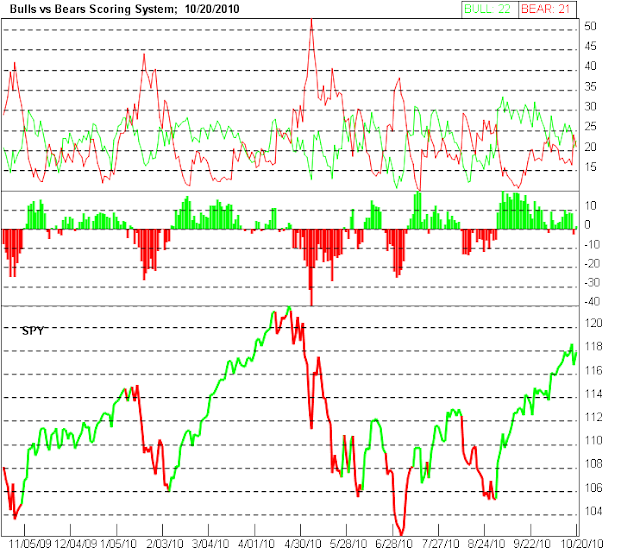

| Short Term Bulls vs. Bears Scoring System | ||||

| Short-term buy signal: Bulls>Bears and Bulls>=25; Sell signal: Bears>Bulls and Bears>=25 | Signal History | |||

| Comments: If this is a football game, we have a great game going on right now, 22 to 21; it is a heavy weight fighting, yesterday was bears day, today is bulls day. The volume today is not very convincing. I opened some shorts and stopped out half of my short positions by the end of day. This is not an optimal mkt condition to bet long or short. I will reduce my exposures. | ||||

| Summary of S&P 500 Stocks Daily Price Change Behavior Model 10/20/2010 | ||||

| Type of Daily Move | # of Stocks | Percent of all stocks | Avg Move | Symbols of the Moves |

| UP over 2 STD | 31 | 6.2 | 2.41 | Click here to show stocks |

| UP between 1 to 2 STD | 168 | 33.6 | 1.39 | Click here to show stocks |

| UP between 0 to 1 STD | 233 | 46.6 | 0.54 | |

| DOWN between 0 to 1 STD | 53 | 10.6 | -0.43 | |

| DOWN between 1 to 2 STD | 9 | 1.8 | -1.36 | Click here to show stocks |

| DOWN over 2 STD | 6 | 1.2 | -3.57 | Click here to show stocks |

| Total # of UP Moves | 432 | 86.4 | 1 | |

| Total # of DOWN Moves | 68 | 13.6 | -0.83 | |

| Total | 500 | 100 | 0.75 | |

| Note: | ||||

| How to read this table | ||||

| Intermediate Term Market Mode | ||||

| Comments: | ||||

| Long Term ZigZag View of SPY | ||||

| Comments: volume is low compared to yesterdays | ||||

Guesstimates on February 12, 2026

2 hours ago