The Augen Chart is to find “extreme” movers (moves over 2STD). These extreme movers are excellent hints to tell you which direction the stock will take.

Generally speaking, when a stock experiences a green mover, it is a strong signal indicates it wants to move even higher. When an uptrending stock experience a 2STD move down, it may indicate the trend change from up to down. However, a move over 2STD may also be an “exhaustion” move.

Below is an example for AMZN.

I use Augen Chart as a check if the stock is safe to go long or not. If the LATEST big move is a red mover(move down over 2STD), I would be very concerned if I have long position in that stock.

If the latest mover is a green mover, or if the latest bar is red, however the stock is higher than the highest red point (i.e., the stock completely recovered from red mover), then I would feel OK to go long.

The NFLX’s 4 latest movers are all green.

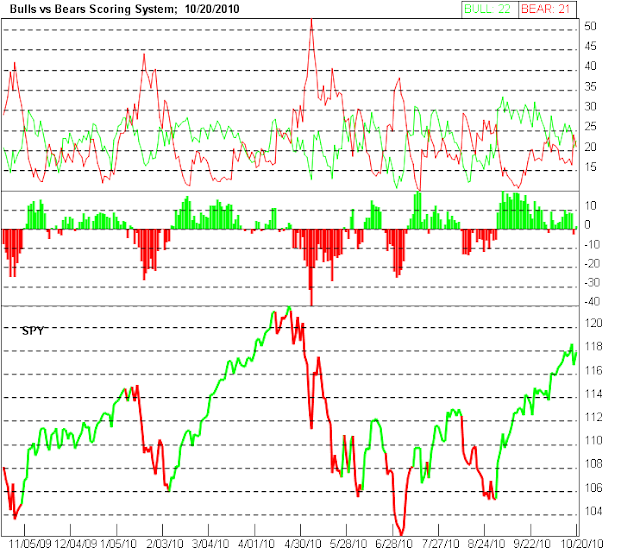

The QQQQ chart tells us the market does not have any red movers since September.

CREE’s latest mover is RED, until it recovers the highest point of red bar, going long here is a concern to me.

I own NVLS, as the latest mover is green:

I make decision to go long or short primary based upon on chart patterns, but I use the Augen Chart as a final check.